Washington, DC – March 2018

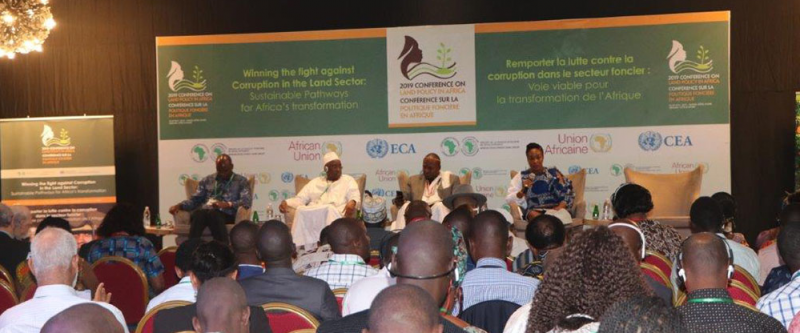

Each year, the Global Donor Working Group on Land organises a session at the Land and Poverty Conference of the World Bank. This year, the session explored new ways donors and other actors can reach and influence the practices of companies investing in land at national level. It looked at key incentives and constraints faced by investors in influencing the practices of investees and tools they use to assess and manage tenure risk. Besides contributions from panelists, introductory remarks were given by Harold Liversage (IFAD and chair of the GDWGL) and moderation by Chris Penrose-Buckley (DFID, vice-chair of the GDWGL).

Links

Develoment Finance Institutions (DFI) perspectives

CDC which is the United Kingdom’s DFI, and the International Finance Corporation (IFC) both represented the DFI perspectives. DFIs invest in some of the most challenging places and at the same time aim to meet very high standards with regard to the financial returns, but also in terms of impact on the environment and on local communities. It was discussed that a significant budget is needed to do due diligence and that client commitment is really essential for paying for due diligence too. According to Samantha Lacey, representing CDC, building relationships with the companies to affirm their commitment, capacity and track record is a useful tool because it enables even company’s without ready-to-go capacity but who are willing to learn and grow sustainably, to be considered on the basis of positive indications from their managers.

But how much influence do DFIs have on companies? Both speakers agree it exists but with limits. One challenge mentioned by CDC was that the investment is made through third party fund managers. Mark Constantine, from IFC, also commented that financial intermediaries make up 50% of IFC investments because of poor global access to bank accounts and access to finance. In such cases, the funds have the same requirements as what the DFIs would maintain themselves, but at the same time, third parties have less capacity to ensure due diligence. Moreover, as primary agriculture is not an area that DFIs tend to invest but invest instead in processing companies for example, it means that the producer is normally one step away. However to counteract that, DFIs often hold board positions which enables them to maintain a good overview of what is going on and have influence on the everyday affairs.

Recommendations

- NGOs should keep holding investors accountable to a higher level and support communities on campaigns. However, while there is a time for campaigns, there is also a time for relationship building and this is also crucial to globally get companies to improve their practices

- Donors should offer research and training for commercial advisors because those are the people whom companies listen to and whom support challenge funds!

Non-Profit and Community organisation perspectives

International Institute for Sustainable Development (IISD) and Namati offered the non-profit and grassroots perspectives at the session. Francine Picard and Vivek Maru, respectively representing IISD and Namati, emphasised that when communities know the rules, they can often get a partial solution and have fairer deals, recover land or even ensure enforcement of environmental challenges. For Namati paralegals should be included as part of a bigger framework by DFI’s. On the question of how to convince companies to invest responsibly, Namati sees as one avenue for DFIs to directly invest in grassroots legal empowerment and equip the people most at risk to enforce their legal rights.

IISD commented that while agricultural investments are very much in line with the African agricultural transformation agenda in the context of the Comprehensive Africa Agriculture Development Programme (CAADP) and the related National Agricultural Investment Plans (NAIP), land tenure issues are emerging from these investments. As a result, many African countries are setting up special legal systems, and this can result in a two tier system, where domestic laws also need to be reinforced. Donors and governments need to support implementation of internationally recognised principles for good conduct, such as the Voluntary Guidelines on the Responsible Governance of Tenure of Land, Fisheries and Forests (VGGT) and the creation of mechanisms for land dispute resolution, while the private sector needs more training on how to deal with land rights. There also needs to be an adoption of fairer contracts and, as an example, the IISD-FAO-IFAD contract templates could support fairer contract farming.

Recommendations

- There is a need for more legally binding commitments that ensure that there is liability on the part of investors when something goes wrong.

- Caution is needed to ensure that there are not two extricated legal systems being utilised, but rather the legal and paralegal should be complementary.